Stuart’s Story: A 75-Year History With The Cradle

Past Cradle Board member Stuart White remembers how his mother Margie formed a strong, resilient family through adoption and reflects on his own support for the historic Illinois adoption agency.

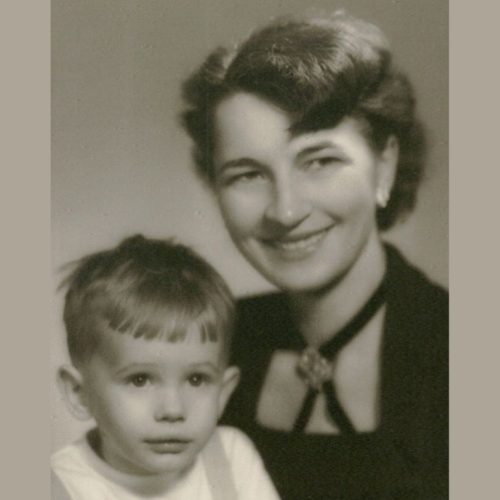

Cradle adoptee and former Cradle Board member, Stuart White, says that when the agency placed him at six weeks of age — over 75 years ago — with a mother who was blind from birth, they took a carefully calculated risk. After just two visits to the Detroit home of prospective parents Margie and Gene White in the fall of 1947, The Cradle agreed that Margie was up to the task (The Cradle worked with adoptive families in multiple states at that time).

“Mothers at that time were viewed as having no boundaries to their abilities,” Stuart says. “Ruth McGee was the social worker assigned to my family. In doing the home visits, I’m certain she had many things to look for: Could this woman who was blind take care of me? Could she change my diapers? Prepare the food? Could she do all the things a person [without visual impairment] does without thinking twice? My dad had a company to run, so could my mother take on all of these challenges without another adult in the house?”

Years later, Margie told Stuart that although Ruth was reluctant at first, she quickly put her reservations to rest. “The Cradle discovered that my mother didn’t have boundaries,” Stuart says with pride.

It was because of his mom that Stuart decided to become more involved with The Cradle and increase his giving to the organization over the years — to honor the remarkable person she was.

Remembering an Incomparable Adoptive Mother

Margaret Jean Cogsdill was born in 1920 with holes in her retinas — an irreparable condition. Her parents never thought of her as having a disability and encouraged her independence. She went to a public school in Detroit that had 80 kids in the classroom. When the family moved to a lakeside community, her parents gave her a canoe, which she paddled solo while her dog Brownie barked from the shoreline to guide her.

Her father, also named Stuart, introduced her to golf — a sport she played passionately until she was 81 — and he would reluctantly pull her behind a motorboat on the lake as she became an accomplished water skier. Margie was also an avid cross country skier — once competing in a Colorado race for skiers who were blind — as well as a skater, swimmer and fisher. The lake was her stage.

Margie earned a degree in economics from Mt. Holyoke College, regularly taking the train to and from Massachusetts on her own. In 1943, she married Gene White, whom she’d met at a party in Grosse Pointe. This was during World War II, and Gene was just days away from shipping out to the Aleutian Islands. The wedding took place in Everett, Washington, where he was stationed at the time.

Starting an Adoptive Family

During the war years, Margie worked at the Red Cross, took graduate classes at the University of Michigan and worked the switchboard at her father’s company, Cogsdill Tool Products.

Gene returned safely after the war and went to work with his father-in-law at Cogsdill. He and Margie adopted Stuart (named after his grandfather) in 1947. They adopted Stuart’s sister, Cindy, also a Cradle baby, in 1949. Two more children joined the family in 1958 and 1960 through an adoption agency in Michigan.

The Whites were always very open and honest with their children about adoption. “They would tell each of us, ‘You were loved, but your mother couldn’t take care of you and we found you. We chose you,’” Stuart says. Stuart recalls having a vivid imagination as a child and envisioning The Cradle, literally, as a giant cradle that held babies until they were taken out and brought home with a family.

“My mother taught us as little kids how to ride a bike, play golf, water ski and ice skate,” Stuart says. “She also taught us how to fish on the lake, and when we didn’t want to put the worm on the hook, she’d say, ‘Give me that,’ and put it right on. She had no fear about those sorts of things.”

Stuart attended DePauw University in Greencastle, Indiana. On the first day of classes, he met a girl named Suzie who was also adopted, and who would go on to become his wife. While he was encouraged to join the family business upon graduation, he didn’t feel the corporate life calling to him. It was the late 1960s, and as a socially conscious person, Stuart decided instead to become a teacher. After earning a master’s degree from Syracuse, he and Suzie settled in Ann Arbor, Michigan, where Stuart taught middle and high school social studies until 2002.

Margie, meanwhile, was a very active volunteer, serving on numerous nonprofit boards and helping to found a teen center in her community. In 1962, she received the “Exceptional Woman of the Year” award from the Detroit Rotary Club. When Gene White passed away in 1973, Margie stepped in and assumed the chairmanship of Cogsdill Tool. The company relocated to Camden, South Carolina, in 1977, and a year later Margie married William Walters, Cogsdill’s new president.

By the summer of 1992 — after chairing Cogsdill for nearly two decades — Margie, then 72, told Stuart she was tired and wanted him to chair the company going forward. He agreed, and for the next 10 years, while he was still teaching, Stuart shuttled back and forth between Michigan and South Carolina.

Returning to The Cradle and Supporting Adoption Services

In 1987, Stuart made his first visit to The Cradle since his placement 40 years prior. Ruth McGee was still with the agency at that time, and she talked with him about first visiting his parents’ home and how impressed she was by Margie.

Although Stuart didn’t return again until 2013, he came with a renewed interest. He describes The Cradle as “a place of dreams” and is quick to acknowledge what a wonderful life he’s had, thanks in large part to his adoptive parents.

“When it became easier for me to start donating, I did, and the reason I started was to honor Margie White,” Stuart says. “No doubt about it. All the issues she’d gone through — and what made me this OK person — needed some kind of return. Her memory was the reason.”

In addition to serving as chairman of Cogsdill Tool, Stuart also chaired the board of Washtenaw Technical Middle College, a Michigan public school academy that enables high school students to earn college credits. He and Suzie have two children, Megan and Caleb. When he joined The Cradle Board in 2014, he had the unique position as the only “Cradle baby” to be serving.

Margie died in April of 2009, a few months shy of her 89th birthday. The following excerpt from her obituary, written by Stuart, beautifully captures the essence of his incomparable mother:

“The awkward act of folding a contour sheet or cooking dinner for a family of six or putting a worm on the hook for her children in the boat adrift on Orchard Lake or shuffling a deck of cards prior to dealing them to the Bridge players at her table go a long way in explaining how gracefully Margie navigated in her sightless world. Her amazing mind cataloged volumes of data without visual cues. Her fearlessness in a perilous world inspired all who knew her.”